Shopify is a strong contender for the world’s favourite, and most popular, ecommerce platform. A class leading piece of software, Shopify operates as an ecommerce platform to help new, small businesses grow their own empires.

However, they’re not only a supportive software platform, they have expanded their offerings into hardware. Once offering up two card readers here in the UK, Shopify now only sells one card reader, and we’re going to review it.

We’re going to see how it fares against industry favourites SumUp, Zettle and Square. We’ll be considering price, performance and POS compatibility - and who knows? Maybe it’ll even be worthy of a spot on our best card readers list.

Overview

Once selling two card readers here in the UK, Shopify now only provides Brits with the option of one card reader. The WisePad 3 reader is somewhat well-equipped, depending on what your needs are.

Weighing in at a nifty 130g and measuring 122 mm (H) x 70 mm (W) x 18 mm (D), this compact little reader can be a great solution to the way in which you accept payments. But only if you’re an iOS user, as this reader is not fully compatible with Android.

This card reader accepts payments via Chip and PIN and contactless, but only works alongside Shopify’s POS iOS app. It connects to the app via your iPhone or iPad, and uses wifi, Bluetooth or your mobile network connection to allow you to accept payments.

Although it has some minor drawbacks, we do feel there are some redeeming qualities with the Shopify card reader, so we’ve outlined them below.

| Feature | Shopify |

| Cost of Reader | £49 |

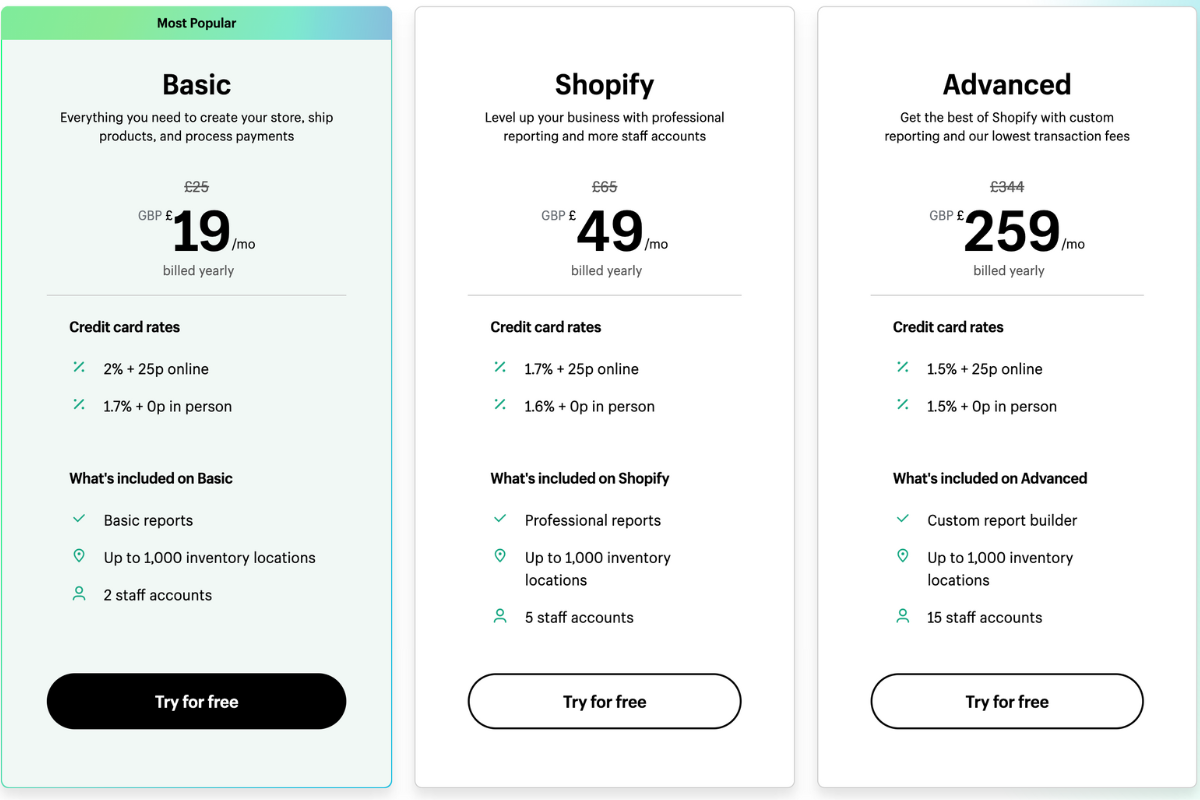

| Monthly Fee | Subscription Fee: Basic - £19 / mo Shopify - £49 / mo Advanced - £259 / mo POS Fee: POS Lite - Free (incl. With every plan) POS Pro - +$89 USD / mo |

| Cards Accepted | VISA MASTERCARD AMEX V PAY MAESTRO Apple Pay Google Pay |

| Payment Type | Chip and PIN Contactless E-Wallet |

| Connection Type | Bluetooth Wifi 3G/4G |

| Warranty | 30 day money back guarantee 1 Year Warranty 2 Year Warranty (POS Pro subscription) |

| Best for? |

|

| Pros |

|

| Cons |

|

Costs

Before we dive in a little further, we are of course going to explore the essentials. When it comes to adding a new piece of kit to your operations or POS set up, one of the biggest things to consider is of course, price.

Compared to other card readers on the market, Shopify comes with a handful more prices to be mindful of. Firstly, you of course purchase the reader for a cool £49. Then there’s the monthly subscription fee, as you cannot buy this card reader without a Shopify subscription. These vary depending on your choice of package, but no matter your subscription you get POS Lite included for free.

There is no contractual obligation with Shopify, so if it’s not for you there’s also no obligation to stay. You also get a 14 day free trial, so you can even decide on this reader long before you commit to any subscription.

| Shopify | In-person | Online |

| Reader | £49 | |

| Shopify Basic | 1.7% per transaction | 2.2% + 20p per transaction |

| Shopify | 1.6% per transaction | 1.9% + 20p per transaction |

| Shopify Advanced | 1.5% per transaction | 1.6% + 20p per transaction |

| Refunds | Original transaction fee (1.5% - 1.7%) | |

| Chargebacks | £10 | |

You can read our SumUp review, Zettle review and Square review to find out just how different Shopify’s pricing is compared to some of the market leaders.

Accepting Payments with Shopify

As a card reader, Shopify’s reader is very straightforward to use. It has both Chip and PIN and contactless capabilities, and transactions are created and completed using the Shopify POS app (they have an Android one available, but only the iOS one actually works).

Payments will arrive into your account within 6 working days, which is slower than other readers on the market. But, there is no fee for this, so if you’re patient six working days is fine.

Practicality of Card Reader

When it comes to selecting a new card reader, you want to know you’re buying something that is easy and practical for both you and your customers to use.

Shopify’s card reader is relatively practical, with its chip and PIN and contactless capabilities, typically accepting payments is easy. Its small size and lightweight feel make an ideal choice for street vendors or mobile businesses, especially since it easily connects to your smartphone via Bluetooth or your mobile network.

In terms of battery life it takes about 4 hours to charge, after which you achieve around 500 transactions per full charge, which is the equivalent of a week of typical trading.

Shopify POS App

To purchase the card reader, and actually have it work, you have to pay an obligatory subscription fee. Like we’ve discussed already, there are a number of subscription plans on offer.

However, regardless of what subscription plan you opt for, you will get Shopify’s POS Lite included. So to know what you’re signing up for, we’re going to explore what’s included with Shopify’s POS.

Payments

You can accept all major card providers and allow customers to play via chip and PIN, contactless or e-wallet. You can also distribute and redeem gift cards via the POS app, and add them to the customers Apple Wallet.

Payments can also be split, allowing you to accept full or partial payments from more than one form of tender. Plus, you can accept and create custom payment types, such as IOUs and payment links.

Reporting

Shopify has equipped its POS system with a variety of reporting tools, to allow you to make informed decisions about your business.

The Dashboard Overview feature allows you to see an overview of your entire business, including in-person and online sales. Plus, inventory management lets you monitor and track the quantity and overall percentage of stock sold each day. You also get access to finance reports where you can track sales, payments and taxes.

Products

To help you reduce time wasted on admin activities, Shopify has equipped its POS with a variety of product specific features.

Firstly, there is no limit on the number of products you can have on your system - whether it’s for your in-person or online store. You can then categorise said products how you please, and add any relevant variations or barcodes to products.

Marketing

With Shopify’s POS you can create customer profiles, so that they can view their order history and save personal details such as billing or shipping information. You can also use this information to contact customers about upcoming promotions or with information about their order.

You can also use this information to create email marketing campaigns or receive customer reviews.

We must conclude the above, with the point that you will get more features with the POS Pro option, but to save time, we’ve simply covered the basics.

Additional Hardware

In addition to the Shopify card reader, you can purchase additional hardware from Shopify to configure your perfect POS setup. Shopify offers tablet stands, printers, barcode scanners, cash drawers and other accessories.

Of course, Shopify has equipped its POS software to be compatible with all of their additional hardware. Connecting any hardware is seamless and allows you to benefit from all of the POS features that are on offer, whilst also being able to troubleshoot any hardware issues from the POS system.

Typically we would reserve the next section to explore what external or third-party software partners the card reader works with. But, as you can imagine, Shopify is only compatible with Shopify.

However, almost every other reader on the market is compatible with Shopify (and other integration partners), so it may be worth considering another card reader but using Shopify for POS.

Is Shopify credit card reader safe?

If you’ve made it this far into our review, firstly, well done. Secondly, it’s probably because you want to know just how safe and secure the Shopify card reader is.

Rest assured that the Shopify card reader is just as safe and secure as any other card reader on the market. Following industry standards, Shopify adheres to the Payment Card Industry Data Security Standards (PCI DSS), meaning that yours and your customers data is protected and never compromised or shared with third parties.

Customer Reviews

At Cardswitcher we like to give you all the facts and figures to help you make informed decisions. That’s why we feel like you also shouldn’t just take our word for it when it comes to reviewing products or services, take a real life Shopify customer's word for it.

Read about what customers have to say on Shopify’s trustpilot account.

Alternative card readers

As we have mentioned throughout this review, this Shopify card reader fares somewhat differently to some of the other best card readers on the market.

To help give you complete transparency and guide you in the right direction, we suggest reading some of other card reader reviews. We specifically recommend reading our SumUp vs Zettle review.

Is the Shopify reader worth it?

Looking at every element of the Shopify reader, we feel that it is most definitely worth it if you are already a Shopify subscriber. You will get a relatively well designed card reader that will slot nicely into your POS setup and business operations, plus all the great POS app features too.

However, we feel that if you are operating on a smaller budget or just starting out, then perhaps the Shopify reader isn’t for you. With a higher purchase price than other readers and somewhat high monthly subscription fees, the Shopify reader is one of the most expensive readers on the market.

With better, cheaper card reader alternatives available (which, by the way, are all still compatible with Shopify’s POS) we feel that Shopify struggles to compete with the other card readers. Plus, a compulsory subscription fee is never ideal for those just starting out.

So to conclude, with its various redeeming qualities such as its ready made all-in-one POS system and reliable ecommerce platform, yes Shopify is worth considering. But, don’t forget about those drawbacks that do unfortunately tip the scale slightly in favour of its competitors.