If you’re just about to open a new highstreet business then there’s probably nothing you’d rather hear than the familiar “Cha-Ching” of the cash register.

Unfortunately for you, we’re not in the noughties anymore and the exhilarating whoosh of the cash drawer has now been all but replaced by the whisper-quiet waving of a contactless card over the PDQ machine.

Given that so much has changed in the world of technology and payments, it’s not hard to see why the EPOS, once the preserve of the high street giants, is now an essential for small businesses - bringing convenience and efficiency to all.

What does EPOS mean?

EPOS, or Electronic Point of Sale System, is an all-in-one hardware and software solution that allows businesses to process transactions face-to-face.

It doesn’t stop there - today’s EPOS systems can also act as business management tools, providing you with the data necessary to make informed business decisions and improve the customer experience and streamline or automate daily tasks. At the heart of every great business is a great EPOS system!

What is the difference between POS and EPOS?

In reality, there’s little difference between the names EPOS and POS now, with many opting to use the snappier POS - “Electronic” is kind of a given in this internet age, isn’t it?

How do EPOS systems work?

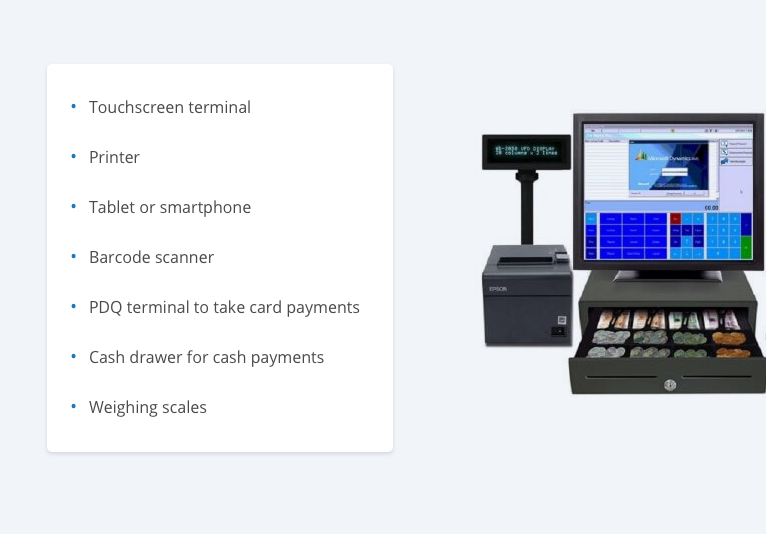

The EPOS usually consists of a touchscreen computer interface, along with a cash drawer, receipt printer, card reader and a barcode scanner. Pretty standard, right?

But what makes this really stand apart from a traditional till is an Internet connection - allowing you to seamlessly integrate card processing across multiple devices and sync inventory in real time.

What are the benefits of using an EPOS system?

EPOS systems make a great first impression on customers and will give your brick and mortar business the neat, professional-looking countertop it deserves. The best EPOS systems also come fully-loaded with additional back office features including accounting apps, staff management and rota tools and customer loyalty functionality.

Here are some of the best features:

Stock control

Traditional POS systems don’t care what stock you’re selling. All you had to do was dial in the price. Up until the dawn of the EPOS system, it was up to the staff to keep track of stock.

Modern EPOS systems allow for sophisticated inventory management. Stock is automatically deducted when you scan through an item, and it can be easily topped up too, allowing you to keep a closer eye on stock levels. You’re less likely to run out of stock and less likely to fall victim to human error.

Improved customer experience

A good EPOS brings two main benefits to your customer experience. First, it looks good, which presents a great image to your customers.

Second, modern POS systems are faster than old ones. If you’ve ever seen a customer huffing and puffing after being told that they can’t use contactless, then you’ll know just how important speed is for the modern consumer. Nobody wants to have to stand around and wait to enter their chip and pin for a card payment these days.

The same is true of Instead of manually entering the price of each item, you can whizz everything through your scanner and let the EPOS calculate the total before taking a payment in a matter of seconds.

Even if you only save 20 or 30 seconds per customer, it adds up quickly and results in fewer long lines and more time to stock the shelves. And if you think that customers don’t care about long lines, consider this statistic. A jaw-dropping 90% will avoid a shop if the queues look too long.

More accurate reports

Again, this is linked to the improved connectivity of EPOS systems over POS systems. While some POS systems did have reporting functionality, they simply can’t compete with the ultra-connected EPOS alternatives.

A lot of EPOS systems will have in-built reporting dashboards, helping merchants to track sales in real time and see their best-selling products, peak trading hours, salesperson performance and so much more.

Many EPOS systems will even integrate with accounting applications, meaning all your sales data is automatically entered. That reduces time spent on manual data entry and massively increases the accuracy.

Flexible pricing

With an EPOS, it’s a lot easier to edit data for one-off events or campaigns and rotate your offers on a weekly basis. Using an EPOS system you can instantly change the price of an item and print labels on demand. It’ll even remind you to change your price labels when an offer has ended so you always have accurate pricing.

Labour Management

Easily manage and alter staff rotas based on hour-by-hour data with the latest and greatest EPOS software. You can sign in staff members using codes or fobs and track their performance (conversions, speed of transaction, upselling) through an easy to use interface.

Digital Receipts

The customer is always right! Now you can prove it too, with digital receipts. Not only does it protect you from fraud but it’ll give your customers peace of mind, helping to build trust in your business.

Track customer data

Because EPOS systems record everything, you can get a much better insight into your customers. For example, you can track which customers buy what and when then use that information to customise promotions or offers. With deft use of the EPOS’ email gathering functionality, you can easily send out template emails to target specific customers and tempt them back into the store.

Choosing the best EPOS system

There are a plethora of EPOS systems available on the market and given their wide variety of features and peripherals, how do you go about choosing the right one for you? We've got a whole post on choosing the best ePos sytem for small business, but here are some key considerations.

#1 Renting or Buying

This isn’t a straightforward calculation. First, you have to decide whether you should rent or buy your EPOS terminal and POS software - both have a number of advantages and disadvantages.

Renting, for example, doesn’t involve a large upfront investment, support is usually first-class and you can usually swap out your system when your business grows.

Buying, on the other hand, means you’re running costs are virtually nothing after you buy the system. You can also adapt or use the EPOS system however you choose and the whole system counts as a working asset.

#2 Peripherals

As I mentioned before, EPOS systems can include a number of different peripherals like barcode scanners, scales, receipt printers and scales. Before you go to buy your EPOS, sit down and think about what you really need in your business. That way you’ll avoid paying for more than you need to.

#3 Software and Integrations

As I’ve discussed in the benefits section above, a lot of an EPOS’s value comes from its own software and its third-party integrations. If you’re looking for an EPOS system, it’s important that you actually get a demo of the software to see how it feels to use in the real world.

Check that each EPOS system you’re looking at integrates with key third-party software like online payment systems and virtual terminals, as well as the various marketing tools available. This is crucial if you’re looking to create a solid omnichannel customer experience.

#4 Customisation

With EPOS systems, the hardware is always easy to customise. Just pick up a new component, plug it in and off you go. The software, on the other hand, can be more problematic.

If you will need to customise your EPOS — for example, adjusting the menu system or restricting access to certain members of staff — check whether you can do it before you buy. Some EPOS solutions focus on either retail or hospitality, and while bespoke customisation is usually possible, it’s likely to cost you a lot of money.

#5 Mobility

Traditionally, merchants have had one fixed checkout and customers came to them. Nowadays, however, business owners are experimenting more with mobile devices. For example, a lot of high street fashion retailers have EPOS software installed on tablets or smartphones which their sales staff wear on lanyards.

This is one of the things you need to decide right at the start as most EPOS systems aren’t portable.

#6 PCI Compliance

It’s almost a given these days that all EPOS are fully PCI compliant but I still recommend you check that is the case before buying a system. You should also check what ongoing responsibilities you will have to keep your EPOS system compliant and secure.

#7 Support and Maintenance

Businesses simply must enquire about the support and maintenance policies behind each EPOS system you look at. Why? Because when an EPOS system goes down, you lose your entire ability to accept payments.

Some important things to consider include your EPOS provider’s customer support hours, level of support, support channels, whether it’s third-party or in-house support and what’s actually included in their support agreement.

Common mistakes when buying an EPOS

Few people have much experience buying an EPOS system. After all, merchants tend to buy a system and stick with it until it stops working. With that in mind, here are some common mistakes I see merchants making when they are buying an EPOS for their business.

Buying hardware first

Some merchants think that they can buy a bunch of hardware, piece it together then install any old software they can find. As you might have guessed, this tends not to work. In reality, a lot of software only works with specific pieces of hardware. Not only that, but you may find it much harder to seamlessly integrate multiple payment methods as your business expands.

Buying the cheapest hardware and software

Have you heard the old adage, “Buy cheap and buy twice”? Well, it’s just as true with EPOS as with anything else. Cheap EPOS systems might be good enough to get you going but they are rarely powerful, flexible or reliable enough to cope with a rapidly growing business. Buying the right technology might cost you upfront but you’ll more than make it back over the course of its life.

How much does an EPOS system cost?

At this point, you’re probably wondering how much all this will cost you. While it’s a little like asking, “How long is a piece of string?” I’ll try and provide some answers below.

- £1,000: An entry-level system usually based around a tablet like an iPad. The iPad is usually paired with other core components like a cash drawer, bluetooth receipt printer and card machine.

- £2,000: At this price, you can pick up an industry-specific (e.g. hospitality, retail, etc.) EPOS system with software that’s designed for your industry.

- £3,000: Advanced EPOS systems will cost over £3,000 and are usually customised to your precise business environment.

Which EPOS system is the best in the UK?

Unfortunately, this isn’t an easy question to answer - particularly as we move away from the one-time purchasing of EPOS hardware and software. Instead, EPOS providers are increasingly offering a SaaS (System as a Service) solution - that’s a fancy way of saying subscription service, for those who don’t know.

While these services may not involve a large initial outlay, their contracts can be equally restrictive. That’s why it’s vital that you find a POS solution that fits your specific business needs.

If you’ve decided on a more minimal, mobile POS system, you may still need to hunt down a suitable card reader. These have varying rates and initial costs, so you’ll need to pay close attention to these. We’ve rounded up the best card readers here.

CardSwitcher are committed to ensuring that businesses don’t overpay on their debit and credit card processing. Whether you’re just setting up shop or you’re looking to shave off some of your outgoings, check out our credit card processing fees comparison tool to save up to 40% on your monthly payments!