Not happy with your current provider? Or looking for a payment processor for the first time? Either way you are in the market for a way in which you can safely and securely accept card payments online.

So if you’re seeking a payment service provider but not sure who is best, then look no further. In this article we here at Cardswitcher are going to conduct a full review of Stripe, exploring essential elements such as pricing, key features and customer service.

Stripe is a payment services provider that allows merchants to successfully and securely accept payments from customers. Whether your customers pay by credit / debit card or an alternative payment method, Stripe is best suited to / tailored for those who operate online.

What is Stripe?

Simply put, Stripe is a payment gateway (or payment processing platform) for online businesses. It equips merchants with the ability to securely transfer funds from a customers bank account into their business account, via credit or debit card, or alternative payment method such as Klarna.

At the very foundation of what Stripe stands for, the industry giant aims to “bring together everything that is required to build websites and accept payments”. Which is why their product and service offerings put ecommerce at the forefront of what they do.

With a “technology first approach”, Stripe has equipped their services with various pre-built integrations that make it easy to customise and design your bespoke payments platform.

They have millions of global customers that range from startups to multinational enterprises, with plenty of resources to support each. Plus, they have begun to evolve alongside the payment service industry and began offering support to omnichannel businesses.

Stripe Pricing

For an online payment system, Stripe are pretty transparent about their pricing. We didn’t have to do a lot of digging, but to make things a whole lot easier for you, we’ve presented them all in a neat little table below.

Firstly however, we must clarify that the prices below are for Stripe’s Standard Integrated Package. Which, in comparison to other market leaders, stack up pretty well. In addition to the Standard prices, Stripe also offers a Custom package, but for these prices you must contact them directly for a quote.

| Payment Gateway Fee | Stripe Fee |

| Monthly Fee | Free |

| Transaction Fee (for UK Cards) | 1.5% + 20p |

| Transaction Fee (for European Cards) | 2.5% + 20p |

| Transaction Fee (for International Cards) | 3.25% + 20p |

| Currency Conversion | 1% +30p for cross border transactions (plus an additional 2% for any currency conversions) |

| Bacs Direct Debit | 1% · 20p min., £2 cap |

| 3D Secure Authentication | 3p per attempt |

| Adaptive Acceptance | 0.08% per successful transaction |

| Instant Payouts | 1% of Instant Payouts volume Minimum fee of 40p |

| Invoicing | 0.4% per paid invoice |

| Chargebacks | £20 per chargeback |

| Recurring Payments | Included with no additional fee |

| Chargeback Protection | 0.4% per transaction |

| Extra Fraud Protection | 4p per screened transaction |

What features does Stripe offer?

If you’re technically minded and want to learn more about the features that make Stripe an outstanding payment gateway, this is the section for you! But if you’re just looking for a reputable payment gateway for your website, you can probably just miss this section out.

- Payment Gateway: Stripe has divided their payment gateway offerings into Stripe Checkout; a hosted microsite that can be easily integrated into your current ecommerce site. And Stripe Elements; offers the same functionality but provides you with more customisation options where you can build a checkout platform that perfectly suits your needs.

- User-friendly API: Offering one of the best APIs (application programming interface) on the market, Stripe has equipped its services with various pre-built platforms that seamlessly integrate into your pre-existing site. These pre-built APIs have been created with the developer in mind, but they allow you to built your payment gateway without any need for coding.

- Customisable Checkout: Designed with the details in mind, Stripe has created another completely customisable element that puts user experience at the forefront. With auto-complete elements, pre-saved payment methods and adjustable brand settings, Stripes checkout is the perfect solution for everyone across the globe.

- Mobile Payment Integrations: No matter the gateway, Stripe allows you to accept payments from your iOS or Android app. You simply add in a few lines of code from one of their mobile software design kits, with no changes being made to the backend.

- International Support: Stripe continues to expand across the globe and is available in over 47 countries, with payments being accepted from over 180 countries. Plus, payments can be accepted and converted into over 130 currencies.

- Accounting Integration: Like all good payment gateways, Stripe will integrate with your existing accounting system for stress-free bookkeeping.

- Security: Stripe meets the PCI-DSS compliance requirements, including two-factor authorisation and that takes a whole load of responsibility off you. Additional screening tools are available for an additional fee.

How easy is it to set up Stripe?

You can create an account for free in a matter of minutes with Stripe. Their huge variety of pre-built software development kits make it super easy to quickly create your payment gateway and begin accepting payments.

However, Stripe is very transparent about how their products and services are designed by developers, for developers. Which means that the ease of setting up is realistically based on your coding experience and abilities.

Because of this, Stripe and us here at Cardswitcher, really recommend being honest with yourself about how confident you are in your coding capabilities before signing up to Stripe. Otherwise, you are likely to both struggle with set up and miss out on the majority of Stripe's best features / selling points.

Setting up an account with Stripe requires you to provide personal details such as name, email address, home address, business details and banking information.

Stripe vs Competitors

So far so good with Stripe. But, how does it fair against its biggest rivals in the market?

In the table below we have pitched Stripe against other much loved market leaders including Square, Adyen and PayPal.

| Provider | Stripe | Square | Adyen | PayPal |

| Online Payment Gateway Cost | 1.5% + 20p for standard cards | 1.4% + 25p for UK cards | 10p + Payment processing fee | 2.9% + 30p |

| Online Transaction Costs | 1.5% + 20p for standard cards | 1.4% + 25p for UK cards | 10p + Payment processing fee | 2.9% + 30p |

| Monthly Fee | Free | Free | Free | Free |

| Payment Processing Time | 3 - 7 Business Days (Option to pay for Instant Payouts) | Next working day (Instant Payouts available for a fee) | 2 working days (Instant Payouts available with a premium subscription) | 3 -5 Business days |

| Set up Fee | Free | Free | Free | Free |

| Termination Fee | Free | Free | Free (2 months notice required) | Free |

| Chargeback Fee | £20.00 per transaction | Free | Varies depending on card provider | £14.00 per transaction |

| Contract Length | No contract. Terminate account at any time. | No contract. | No contract. | No contract. |

| Trustpilot Rating | 3.2 / 5 | 4 / 5 | 1.5 / 5 | 1.3 / 5 |

From the information presented above, we can see that Stripe is similarly priced to other market leaders with no monthly, set up or termination fees. Alternatively, this highlights that Stripe has the highest chargeback fee, and unless you opt for instant payouts you could be waiting up to a week for your funds. Whereas, Square has your funds in your account the next working day for no additional fee, lower transaction fees and a pretty commendable Trustpilot score.

Customer Service

Businesses could learn a thing or two about customer service from Stripe. They are available 24/7 via email, phone or chat bot to help customers out with any queries they may have, completely free of charge. Or, if you are a slightly larger enterprise or fast growing business and anticipate that you may require more support, you can upgrade to a Premium Support plan.

On top of all of this, their website is well equipped with handy guides to help you with everything from set up and new product launches to essential industry updates.

Stripe Reviews

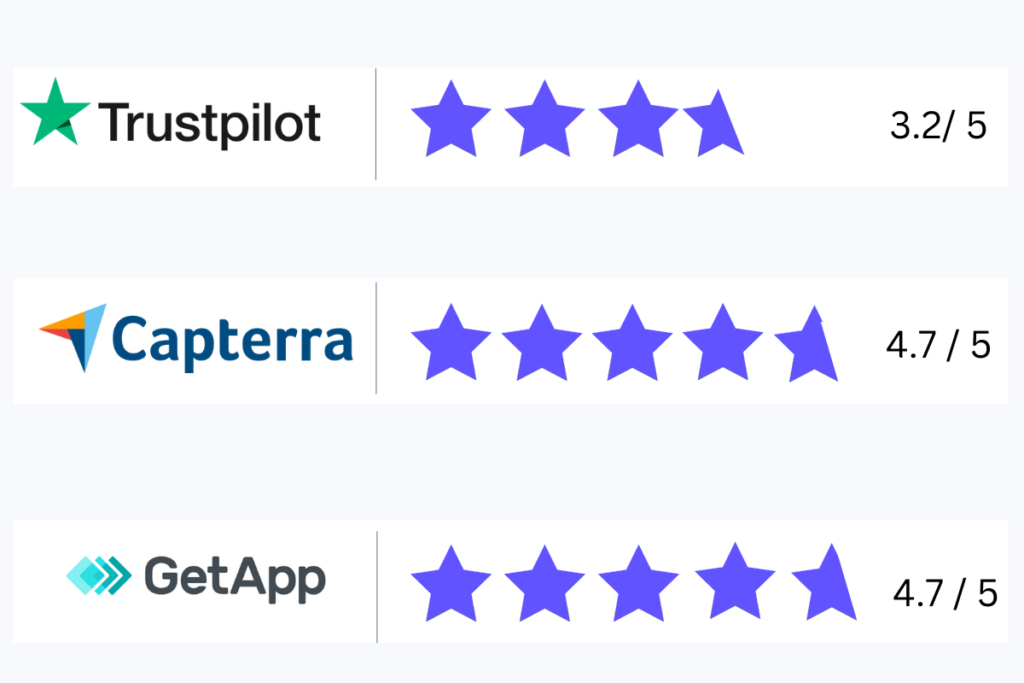

As one of , if not the best, payment provider available it is no wonder that Stripe has over 2 million global customers and more than 3 million websites using it as their payment gateway. But don’t just take our word for it, from Trustpilot, Capterra and GetApp, you find out what real Stripe customers have to say about them.

The above reviews showcase the positive aspects of Stripe, and of the tens of thousands of reviews that have been posted online, yes, the majority are positive reviews.

However, Stripe is not free from flaws, which again has been highlighted throughout multiple reviews. The most common pain points that are mentioned include inconsistent fraud protection, high hidden fees and the lengthy settlement period. Since all of the reviews are public and have been posted on review sites such as the ones linked above, we suggest you read a few to find out just exactly what it is you are signing up for with Stripe.

Conclusion

Stripe is well-loved for its huge range of features and competitive prices. But, an exploration into customer reviews highlighted their number of hidden fees and slow payouts.

So, would we recommend Stripe as a payment gateway? The answer is yes.

They are relatively well priced (apart from that pricey chargeback fee!) and have a 24/7 customer support service, which is great for anyone just getting started. Plus, their huge range of developer focussed tools and features allow you to build a payment gateway that works for both you and your customers.

However, we do feel that Stripe is not suitable for non-profit organisations or very small enterprises as it is a very feature rich piece of software that newbies will certainly struggle with. Therefore, we would also warn of any businesses who have very little coding experience or do not currently have an in-house software engineer who can play around with it for you.

If you want to know more about other payment industry services, explore Cardswitcher’s list of Best Card Readers.