The world of debit and credit card payments has been completely transformed with the introduction of the mobile card reader. Mobile card readers go by different names, including mobile point of sale system or mPOS.

Mobile card readers pair with an app installed on a mobile device like a smartphone or tablet. From the mPOS app, you can process transactions, generate receipts, produce commercial reports, sync your inventory and more.

Depending on what operating system your device uses, what features you need for your business and what your budget is, there's almost certainly a card reader and POS app for you. Here are my top picks.

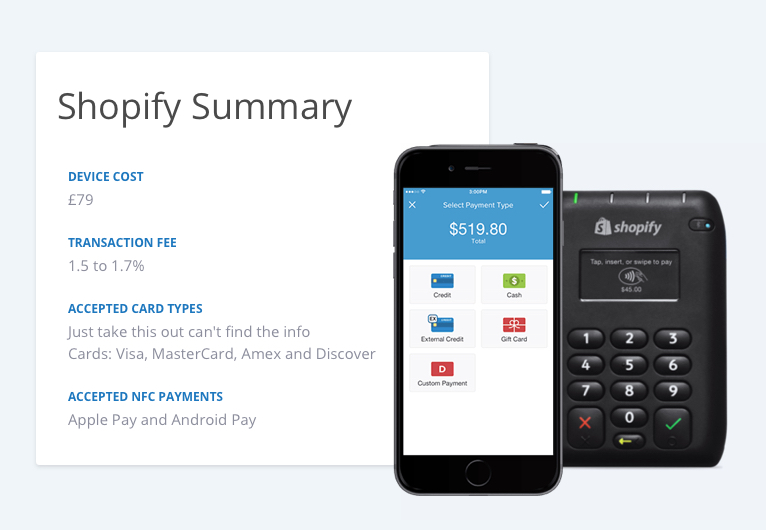

Best Card Reader App for Phones: Shopify POS

Shopify was founded in 2005 and since then has grown into one of the world's major players in the eCommerce software market.

In 2013, Shopify expanded into the brick-and-mortar space by launching their card processing system and app, Shopify POS. For Android and iPhone users alike, the Shopify POS is one of the most impressive POS systems. The Shopify card reader is perfect for merchants who prefer to use a smartphone or tablet, allowing you to hook up the system to a cash drawer and handle credit card processing with ease.

Just like the eCommerce Shopify software, the card reader app works seamlessly. It boasts a very user-friendly interface and integrates effortlessly with the eCommerce platform.

If you are a small business owner who also operates primarily through an online store, Shopify POS is the ideal mobile app for you.

What features does it have?

Shopify is a robust card reader app with an intuitive interface, comprehensive payment options, and customisable reporting features. The user experience really is first-class.

I’ve divided the main features of this card reader app into the following categories.

Payment Features

- Customers can split their payment between payment options, paying part cash, part credit or debit card.

- EMV-compliant technology so the Shopify Reader can accept Europay, Mastercard, and Visa. It also accepts NFC payment options like Apple Pay and Google Pay.

- Process refunds to a customer's bank account through the app or refund a customer with store credit.

- Create custom gift cards for customers to redeem.

Checkout Features

- Set up custom discounts for single products or entire orders.

- Create custom receipts with important store information you wish to include.

- Save customers' contact details and shipping address for future reference, with their permission.

Store Management Features

- View your order histories and filter by individual customer, product, and date of purchase.

- Create separate, PIN-protected staff accounts for your employees, letting you keep track of cash flow over the course of the business day.

- Produce exportable sales, orders, and inventory reports.

Product Management Features

- Sync your inventory with product listings so customers cannot buy products that have gone out of stock.

- Organise your product listings according to your desired categorisations.

What are the monthly fees/transaction rates?

There are several different plans you can choose with Shopify POS, each geared towards different sizes of merchants and business objectives.

The Lite Plan

- This is the cheapest option with a monthly fee of £6.88/month.

- In-person debit and credit card transaction rate of 1.7%.

- Online debit and credit card transaction rate of 2.2% + 20p.

- Best suited to pop up shops who are looking for a basic debit and credit card reader app without all the fancy fixings.

The Basic Plan

- Monthly fee of £22.17/month.

- In-person debit and credit card transaction rate of 1.7%.

- Online debit and credit card transaction rate of 2.2% + 20p.

- Includes 2 staff accounts and the use of different social media sales channels.

The Shopify Plan

- Comes in at £60.40/month.

- In-person transaction rate of 1.6%.

- Online transaction rate of 1.9% + 20p.

- Includes 5 staff accounts, abandoned cart recovery, and professional reports.

Advanced Shopify Plan

- The best plan for larger scale merchants at £228.59/month.

- The lowest transaction rates of 1.5% in-person and 1.6% + 20p online.

- Includes 15 staff accounts, gift cards, advanced report builder, and calculated shipping rates.

When will I receive payment?

With Shopify, UK merchants have to wait anywhere between one and three business days for customer payments to enter your bank account.

Customer support

If you ever have any queries or concerns, Shopify has technical support available around the clock via phone, email, or live chat.

It’s easy to get in contact with a live agent and if you do have to wait, you’ll be told how long you can expect to hang around for, which is handy for organising your day.

Shopify has an extensive and well-written support section on their site to guide you through some of the most frequently experienced problems, so you may not even need to reach out to customer service.

Security

Shopify is Level 1 PCI compliant, adhering to the Payment Card Industry Data Security Standard (PCI DSS). All Shopify online stores are automatically PCI-compliant.

The app is also covered by Transport Layer Security (TLS) which encrypts all data transferred from the chip reader and through the app to protect you and your customers’ data.

If you spot any problems, then you can report it to HackerOne. Shopify works with a network of hackers to monitor the security of the system, allowing them to address red flags on an ongoing basis.

Overall verdict

For iPhone and Android device users alike, Shopify POS is a fantastic mobile credit card reader app.

It’s ideal for pop up shops, allowing you to take customer payments with ease.

The card reader app is a firm favourite with industry reviewers, as you can see here:

If you fancy trialling out Shopify POS, you can download it on the Apple Store or Google Play store.

Mobile payment is incredibly simple with Spotify POS!

| Top Features | Split payments, EMV-compliant, pin-protected staff accounts, inventory syncing |

| In-Person Transaction Rates | 1.5% - 1.7%, dependent on plan. |

| Monthly Fee | £6.88 – £228.59, dependent on plan. |

| Payment Deposit Time | 2-3 business days |

| Customer Support | Extensive online guides and agents via phone/email/live chat. |

| Security | Level 1 PCI-compliant, TLS encryption, and ongoing monitoring with hacker networks. |

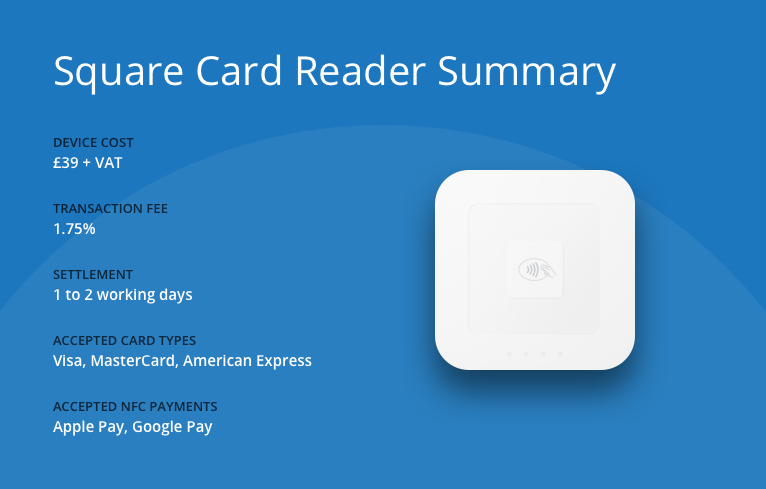

Best Card Reader App for Tablets: Square POS

We recommend the Square card reader and app if you are looking for the best credit card reader app for tablets. It works great on Android tablets as well as iPads.

Square was founded in 2009 in San Francisco and they launched the Square reader and POS system in the UK in 2018.

Despite arriving in the UK five years after prominent apps like Shopify and SumUp, Square has still managed to establish itself as a firm leader in the sector.

What features does it have?

The Square POS covers all the basic features like customisable invoices and receipts, inventory management and reporting.

What has really helped it push ahead of its competitors is the upgraded package options which help you tailor the system to better serve your industry.

Here are some of Square’s main features.

Payment Features

- Split payments between different credit and debit cards and accept all major card providers include Visa, Mastercard, and American Express.

- Use the invoicing tool to create and send invoices using customisable templates.

- Customers can enter their PIN securely on the device screen (known as PIN on glass).

Checkout Features

- Print receipts using Bluetooth receipt printers.

- Enables you to instantly email receipts to customers, which can be customised as needed.

Store Management Features

- Integrate with common bookkeeping systems like QuickBooks and Xero, allowing you to sync sales data to produce reports.

- Customer feedback can be obtained and monitored in the customer section.

- Ability to track new and existing customer behaviour by examining expenditure trends.

Product Management Features

- One of the most advanced inventory management systems, sending you alerts when products are low in stock or sold out.

- For Square POS for Restaurants, you can create your menu on the app for customers to browse through.

What are the monthly fees/ transaction rates?

Square offers one of the most simple pricing plans for customers. There are no hidden or monthly fees for its basic plan. Square works on a pay-as-you-go model so you only pay transaction fees when you process payments.

The Square POS system charges 1.75% for chip and PIN or contactless payments, and 2.5% for typed-in card payments.

There are admittedly some extra fees when you upgrade your package to newer Square applications like Square for Retail POS, Square for Restaurants POS and Square Appointments.

When will I receive payment?

Square offers Instant Deposit which allows you to receive payment from transactions to your bank account immediately, for a charge of 1% of the transferred amount on top of the usual processing fee. Alternatively, transactions are paid to merchants within 1-2 business days.

Customer support

You can reach Square's customer service via multiple channels, including social media, email, and phone.

There have been some complaints from customers about the difficulty reaching Square advisors but there are multiple ways to find information without speaking to anyone.

If you’re experiencing any issues with the app, you can do a pre-emptive check of Is Square Up?, which will alert you of any technical issues that might be affecting the service.

The Square Seller Community is a great way to source quick answers to FAQs or more obscure issues that other users have also experienced.

Security

Square is transparent about the safety measures they employ to keep you and your customers’ information safe.

The whole POS system is fully PCI compliant. Whilst some merchants and customers are concerned about the “PIN on Glass” function, the feature is compliant with new PCI Security Standards.

The app also uses data encryption to secure credit card details as they are processed. Your device and app never store unencrypted data.

In-house teams at Square and public bounty researchers consistently test out their security systems. They keep on top of information about emerging threats and fraud rings to ensure that your system is always safe and sound.

Overall verdict

If you are looking for the best debit and credit card reader app for tablet, look no further than Square.

Industry experts and customers alike have nothing but praise for Square. These review grades speak for themselves.

- G2: 4.6 / 5

- Capterra: 4.7 / 5

- TrustPilot: 4.7 / 5

Square's premium packages offer a wealth of extra features that make it ideal for larger scale businesses like restaurants where a tablet is a practical alternative to card reader terminals and printed menus.

| Top Features | PIN-on-glass, wireless receipt printing, syncing with bookkeeping systems, inventory level alerts. |

| In-Person Transaction Rates | 1.75% / 2.5% keyed-in. |

| Monthly Fee | N/A |

| Payment Deposit Time | 1 - 2 business days. |

| Customer Service | Square Seller community resource, www.issquareup.com, customer service reps via phone, social media, and email. |

| Security | PCI-compliant, encryption, in-house and outsourced security testers. |

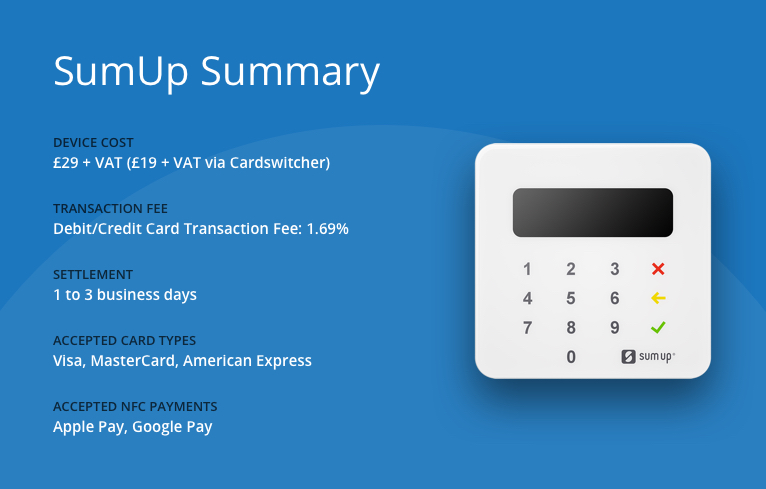

Best Debit/Credit Card Reader for Apple: SumUp

SumUp is an affordable and intuitive mPOS system that serves 31 countries — impressive! They handle 100,000 transactions per day, so you don’t need to doubt their breadth of experience.

The system works on iOS 7.0 (roughly iPhone 4 and newer) or higher so the SumUp card reader is a good choice for Apple devices.

The POS app launched in 2012, joining some of the early contenders on the mobile card reader app market. You can tailor the Square app for use in different industries, whether it be retail, hospitality, service, or something else.

What features does it have?

SumUp has most of the main features that the other reviewed apps have, though it is lacking in some advanced features like split payments, manual card entry and inventory counting.

Payment Features

- Customer tipping is available.

- Uses SMS payments where customers are sent a text to enter their payment details into a web form.

Checkout Features

- Provides email and SMS receipts.

- Modify tax settings from within the app.

Store Management Features

- Create multiple user profiles with basic restrictions.

- CRM and loyalty programmes.

Product Management Features

- Online booking system.

- Create custom “shelves” for different category labels for customers to browse through.

What are the monthly fees/ transaction rates?

Like most card readers (and unlike traditional card terminals), SumUp doesn’t charge any monthly fee.

For contactless or chip and PIN payments, they charge a 1.69% transaction fee for Chip & PIN transactions and 2.95% for keyed in transactions.

When will I receive payment?

SumUp has one of the longer payment deposit times out of these reviewed apps. Transactions normally clear to a merchant's bank account within 2-3 days.

Customer support

For most of your queries, SumUp’s support section will do the trick. For more complicated problems, customers can reach Square's support via phone and email.

Security

SumUp is fully PCI compliant and uses SSL (Secure Sockets Layer) and TLS (Transport Layer Security).

Additionally, they use PGP (Pretty Good Privacy) which is the international standard for secure personal data storage.

Overall verdict

SumUp has a massive global reach with over 1 million merchant customers, so they must be doing something right!

It’s hailed as one of the top card reader apps and has glowing reviews from various experts:

- Trustpilot: 4.4 / 5

The app is one of the most appealing options for small businesses, offering a super cheap service without tying you into a long-term contract.

| Top Features | SMS payments, tax settings modification, multiple user profiles, custom shelves. |

| In-Person Transaction Rates | 1.69% (2.95% keyed-in). |

| Monthly Fee | N/A. |

| Payment Deposit Time | 2 - 3 business days. |

| Customer Service | Extensive online support section, 6-day phone lines, email. |

| Security | PCI-compliant, SSL and TLS encryption, PGP. |

Best Debit/Credit Card Reader for Android: PayPal Here

For the eager Android users amongst you, you’ll be pleased to hear that the PayPal Here mobile credit card reader app is terrific! It's also compatible with Apple and Windows devices.

The PayPal Here card reader launched in 2012, another early contender in the mobile payment processing market.

The POS system was the next logical step in PayPal's quest to fully cater to the merchant services division.

What features does it have?

PayPal Here has some great features, very similar to its competitors. It is particularly good if you require multiple user accounts so is well-suited to larger merchants.

Payment Features

- Allows you to complete full or partial refunds via the app.

- Functionality to accept E-signatures from customers.

- Can key in card numbers manually and record cash/cheque payments separately, keeping all records in one place.

Checkout Features

- Email receipts to customers or print paper receipts using a wireless receipt printer.

- Set up tipping at the checkout.

- Can add discounts for sales.

Store Management Features

- Send invoices to customers via the app.

- Add sub-user accounts for no extra charge.

Product Management Features

- Can build a product inventory with photographs, costs and product descriptions.

- Set up "add-on" items.

What are the monthly fees/ transaction rates?

Like Square, there are no monthly fees for PayPal Here. Instead, there are two fee structures you can opt for, Blended or Interchange Plus.

| Total Monthly Sales | Blended | Interchange Plus |

| Up to £1,500 | 2.75% | IC + 2.5% |

| £1,500.01 - £6,000 | 1.75% | IC + 1.5% |

| £6,000.01 - £15,000 | 1.5% | IC + 1.25% |

| £15,000.01 - £25,000 | 1% | IC + 0.75% |

The pricing structure is favourable to high volume businesses, although it's still not that competitive compared to traditional rented terminals.

When will I receive payment?

As with most of the other reviewed apps, you will generally receive payment after 1 to 2 working days.

Customer support

You can reach PayPal reps via phone, email, social media, or from within the PayPal Here app.

They operate generous call centre hours, between 8am to 8:30pm on weekdays and Saturdays and 9am to 8:30pm on Sundays.

Some users have reported that the phone support is a bit hit or miss but our experience was fine. PayPal also tries to minimise the need for you to chat with a live agent via an extensive community forum.

Security

You can feel secure operating on PayPal Here. They are PCI compliant and certified by Visa and Mastercard.

They offer end-to-end encryption and their Chip and PIN technology is backed by world-class risk and fraud management systems. Their team of security specialists monitor your transactions 24/7 to pinpoint any anomalies, making sure your account is secure.

Overall verdict

Out of all the credit card reader apps we’ve reviewed here, Square offers the most comprehensive features, but PayPal Here is still great if you have both a large online and in-person presence.

Industry experts give it great reviews that should fill you with confidence about its capabilities:

- Software Advice: 4.6 / 5

- G2: 4.4 / 5

PayPal Here has all you need to process payments on-the-go. It is an intuitive mobile app that proves very cost-effective.

| Top Features | Refunds, discounts, unlimited user accounts, build detailed inventory. |

| In-Person Transaction Rates | 1% - 2.75%, depending on merchant rate. |

| Monthly Fee | N/A. |

| Payment Deposit Time | 1 - 2 days. |

| Customer Service | Community forum, in-app, 7-day phone lines, email, social media. |

| Security | PCI-compliant, EMV-compliant, encryption, 24/7 security specialist monitoring. |

Card Reader App Overview

These are some of the best card reader apps for the best card readers available. There is something to suit every size of business, varying budgets, and differing payment processor needs.

Whether you're looking for a credit card reader for Android or Apple, for your mobile phone, tablet, or iPad, there are some great devices on the market.

The Square card reader app receives the highest praise on review sites across the board, boasting the greatest functionality amongst all credit card reader apps at a very reasonable price tag.

Shopify POS steps in next, hot on the heels of Square. Shopify is the perfect flexible option for those who vary in their usage of credit card reader apps, particularly good if you’re looking for a card reader for phone usage.

SumUp offers an intuitive, cost-effective POS system that is ideal for merchants handling lower volumes. It has all the essentials, but if you want something with fancier bells and whistles, perhaps look elsewhere.

Online payments giant, PayPal, has a great card reader and app that's particularly attractive if you're already using PayPal to process eCommerce payments.

In summary, the best card reader app for you will depend on a number of factors, but these 4 mobile apps for credit card processing are the best of the bunch.

| Shopify | Square | SumUp | PayPal Here | |

| Top Features | Split payments, EMV-compliant, pin-protected staff accounts, inventory syncing. | PIN-on-glass, wireless receipt printing, syncing with bookkeeping systems, inventory level alerts. | SMS payments, tax settings modification, multiple user profiles, custom shelves. | Refunds, discounts, unlimited user accounts, build detailed inventory |

| In-Person Transaction Rates | 1.5% - 1.7% | 1.75% / 2.5% keyed-in | 1.69% (2.95% keyed-in). | 1% – 2.75%, depending on merchant rate. |

| Monthly Fee | £6.88 - £228.59 | N/A | N/A | N/A |

| Payment Deposit Time | 2 - 3 business days | 1 – 2 business days. | 2 – 3 business days. | 1 – 2 business days. |

| Customer Support | Extensive online guides and agents via phone/email/live chat | Square Seller community resource, customer service reps via phone, social media, and email. | Extensive online support section, 6-day phone lines, email. | Community forum, in-app, 7-day phone lines, email, social media |

| Security | Level 1 PCI-compliant, TLS encryption and ongoing monitoring with hacker networks. | PCI-compliant, encryption, in-house and outsourced security testers. | PCI-compliant, SSL and TLS encryption, PGP. | PCI-compliant, EMV-compliant, encryption, 24/7 security specialist monitoring. |