Whether you’re a newborn entrepreneur or small business veteran, it looks like you’ve found yourself in the market for a new method of accepting card payments.

Accepting card payments seamlessly and hassle free is key to your businesses success in a post-pandemic world. Whether it’s chip and PIN, contactless or e-Wallet, chances are the majority of your customers will want to pay via card.

But, with so many options available, it can be difficult to know what’s right for you.

Most people opt for one of the best mobile card readers, as they can be cheaper and more convenient. However, they’re not suited to every business, so it is also worth exploring the classic PDQ machine.

Not sure what a PDQ machine is? Read CardSwitcher’s ultimate guide to PDQ machines to discover whether or not it’s right for you.

What is a PDQ machine?

It makes sense to define PDQ machines on the first step on our whistle stop tour (ahem, ultimate guide).

In simple terms, a Processing Data Quickly or PDQ machine is a device merchants use to accept card payments from their customers. They are also commonly referred to as card machines, card terminals, point of sale terminals/machines and chip and PIN machines.

The machine works by reading the data stored on a customer’s card, accepting their PIN and then sending the information to the acquiring bank.

What does PDQ stand for?

With a PDQ machine it quite literally does what it says on the tin.

PDQ stands for Processing Data Quickly, which is exactly what it does. Within a matter of seconds data is transferred from a business to the customer and then back again, resulting in a complete sale.

What is the difference between a PDQ machine and other card machines?

According to globally successful card machine provider Zettle, the difference between PDQ machines and other card machines is nothing.

Whether it’s a traditional countertop chip and PIN machine, or a modern mobile card reader, any device that accepts card payments safely and securely is a PDQ machine.

If there is any identifiable difference between a PDQ machine and a mobile card reader, it is purely aesthetic (and occasionally price!).

How does it work?

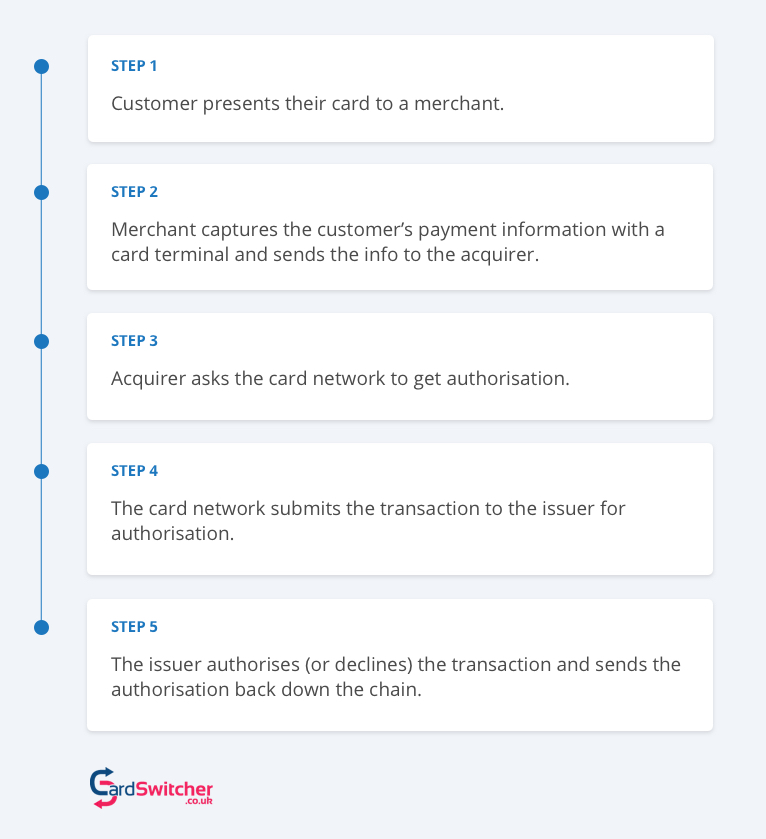

Without getting too technical, a PDQ machine captures your customer’s card data (specifically the PAN/16 digit number), authentication data from the customer (their PIN) and transaction data (the value) from the merchant and transmits this data to the merchant’s acquirer.

The merchant’s acquirer then transmits that data to the card scheme (usually Visa or Mastercard) and the card scheme transmits the data to the issuing bank (the bank who issued the card).

The issuer checks if there are sufficient funds in the account and whether the card has been reported stolen. If there aren’t sufficient funds or the card has been reported, the issuer declines the authorisation. If there are sufficient funds and the card hasn’t been reported, the issuer authorises the transaction.

Finally, the issuer passes the authorisation (or rejection) back down the chain from card scheme to merchant acquirer to merchant. At the end, the merchant’s POS gets a message telling it if it can proceed with the transaction.

The whole process normally takes one or two seconds and happens while the customer and merchant are making small talk.

I know that’s a lot to take in so here’s a truncated version!

Benefits of a PDQ machine

Whether you call it a card machine, chip and PIN reader or card reader, a PDQ machine is a great addition to any small business.

But just how great of an addition is it? Well, we’ve done our research to uncover the many benefits of a PDQ machine:

- Accepting card payments easily is what your customers want, especially with the use of cash as a form of payment on the decline.

- Your customers can just tap and go with contactless payments, making it the ultimate choice for convenience.

- Safe and secure, all card readers have built in security software that protects both yours and your customers data from being compromised.

- No cash handling, an all round benefit as card payments are more hygienic, you don’t have to store cash on your premises or take the time to deposit the money into your bank.

Of course all of the above will already ring true if you already successfully accept card payments.

Types of PDQ machines

In the UK, there are three different flavours of PDQ machine: countertop, portable and mobile. All three have different advantages and disadvantages so there’s not really one that’s better than the others for all situations.

But for the purposes of our ultimate guide to PDQ machines, we have included an explanation of each of the “flavours”.

Countertop

Countertop PDQ machines are the most common sort of machine, and you probably see dozens on a daily basis.

These machines are perfect for businesses that only take payment from one designated section of your premises. This is the case for most retail businesses where payment is made at a set checkout.

Countertop PDQ machines are physically attached to the POS system and communicate externally via a phone line or ethernet cable.

Common countertop PDQ machines include the Spire T4220, Spire SPc50, Ingenico iCT220, Ingenico iCT250 and Verifone VX520.

Portable

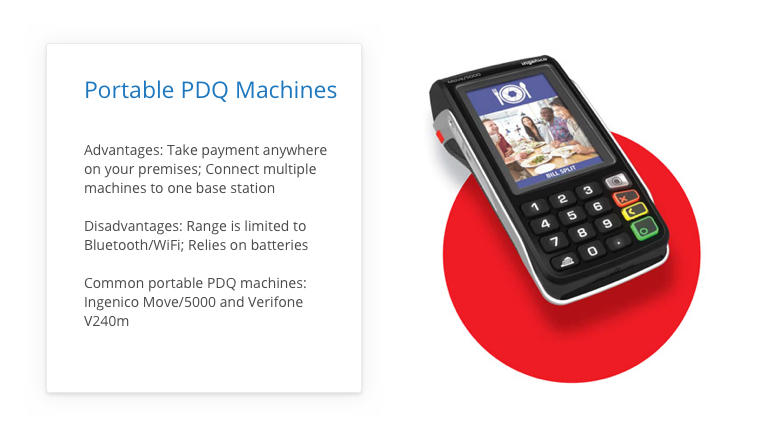

Portable or moveable PDQ machines connect to a base station via Bluetooth or WiFi and are powered by a battery, which allows you to move around your premise with it.

These types of PDQ machines are useful for when you have large premises and need to take payment anywhere within it and not just at a set checkout area.

Portable machines are most often used by bars and restaurants so staff can take payment from a customer at their table.

Bluetooth machines have a maximum range of around 100 metres. However, this is likely to be substantially less in buildings. WiFi machines should have a range of up to 50 metres when used inside.

Common portable PDQ machines include the Spire M4240, Spire SPw60, Ingenico iWL222, Ingenico iWL252 and Verifone VX680.

Mobile PDQ

A mobile PDQ machine will use the mobile telephone network (GPRS or GSM) to stay connected outwith a fixed business location. In theory, this means you can use a mobile PDQ machine to take payment anywhere in the country. However, since you’re reliant on the mobile phone signal, you’re out of luck if there’s no reception.

Mobile PDQ machines are most commonly used by businesses where payment is taken off premises, for example, tradesmen, debt collectors, market traders, travelling salespeople and so on.

Common mobile PDQ machines include the Spire M4230, Spire SPw70, Ingenico iWL221, Ingenico iWL251 and Verifone VX675.

Mobile Card Reader

In recent years, a new breed of mobile PDQs has emerged called mobile point of sale devices (mPOS) or simply card readers.

A card reader is simply a compact terminal that pairs with a smartphone or tablet via bluetooth. The smartphone or tablet then connects to the acquirer via WiFi or 4G.

Mobile card readers are favoured by micro businesses because they are typically inexpensive to buy and have no ‘add-on costs’ other than the transaction fee, which is materially higher than a traditional leased terminal.

Common mobile card readers include the Zettle, SumUp and Square devices.

What types of payment can you take using a PDQ terminal?

Modern PDQ machines are equipped to accept all four common forms of card payment.

Back in the day PDQ machines were only able to accept chip and PIN or magnetic stripe, but the majority of PDQ providers have moved with the times and equipped their machines with the capability of accepting all types of card payment.

Chip and PIN:

Still widely appreciated as the safest method of paying by card, PDQ’s are well equipped to accept chip and PIN payments.

Contactless:

When it comes to paying with card, the public’s favourite method is contactless. Quick, easy and secure, modern PDQ machines are fitted with the software that allows you to accept contactless payments with ease.

Mobile/E-Payments:

Contactless mobile payment systems like Apple Pay and Android Pay are relatively new to the payment industry. However, they are widely popular with the general public, especially with everyone owning either a smartphone or smart watch.

Their spike in popularity, has again encouraged PDQ providers to equip their terminals with the software that securely accepts contactless e-payments.

Magnetic Stripe:

An outdated, yet occasionally used form of accepting card payments. Customers swipe their card down the side of the PDQ machine, where the card details will be read and the customer subsequently signs their receipt as proof of identity.

How much does it cost?

We wouldn’t be able to call this the ultimate guide to PDQ machines if we didn’t give you a breakdown of the costs.

This is a question we get asked a lot. And I mean, a lot.

Unfortunately, there’s no definite answer to the question as quite how much you’ll have to pay depends on your business, your requirements and your card turnover.

PDQ machines have a number of fees you have to pay throughout your contract. In the next few sections, we’ll run through common charges, which we have categorised into the following segments:

- Upfront Costs

- Monthly Fees

- Extra Fees

Upfront Costs

Unfortunately, PDQ machines have a couple of upfront costs you have to deal with before you can get up and running.

- Set Up Fees: A (sometimes avoidable) one-off fixed fee for the installation of new merchant facilities. The setup fee typically sits at around £50–150. If you negotiate with your supplier, they are sometimes willing to drop this fee.

- PDQ Machine Purchase Fees: When it comes to the actual PDQ machine, you’ve got two options: buying or renting (more on the choice later.) If you want to purchase your PDQ machine, it will cost quite a lot, typically anywhere from £200 to £800, depending on how fancy the terminal is.

Monthly Fees

There are a fair few monthly fees you should expect to pay, ranging from the basic cost of renting (if you don’t buy) your PDQ machine to the percentage your acquirer charges on each transaction.

Here is a quick overview of what monthly charges you should expect and how much they will be.

- Terminal Hire: This is the basic rental charge for your PDQ machine. Typically £14–16 for a fixed countertop machine, £17–21 for a portable machine and £20–24 for a mobile machine. If you have bought your PDQ machine outright, you obviously won’t have to pay this.

- Merchant Service Charge: This is the charge on every credit or debit transaction you accept. Typically around 0.25–0.35% for debit cards, 0.7–0.9% for credit cards and 1.6–1.8% for commercial credit cards.

- Authorisation Fees: An additional charge for every authorisation on every transaction to test the payment method. Typically around 1–3p per transaction.

- Minimum Monthly Service Charge (MMSC): A charge levied if your transactions fall below a certain level. If your other fees come to more than the minimum monthly service charge, you aren’t charged the MMSC. Typically set at £10–20 per month. Since your provider is investing a lot of money upfront, the MMSC is there to ensure they make back their investment.

At Cardswitcher, we help merchants compare their payment processing options. You could save up to 40% in your card processing fees in just 2 minutes!

Extra Fees

There are a couple of one-offs or irregular fees that you might experience over your contract. The most common is the chargeback fee, which kicks in every time a cardholder requests a chargeback. This typically sits around £10–20 per instance.

How do I choose the right PDQ machine for my business?

With so many options to choose from, selecting a card machine can be a tricky, time consuming process. But at Cardswitcher, we believe that it doesn’t have to be.

First of all, the best way to choose the right machine for your business is to simply assess:

- What type of business do you have? i.e. retail, hospitality etc.

- How does your business operate? Do you have a set area for checkout? Or do you go to your customers?

- Where do you operate? Do you have a fixed premise? Or are you the likes of a food truck, mobile hairdresser or construction company?

Secondly, look at the varying types of PDQ machines that are available, and assess their suitability to your business. Below we have outlined the four types of card machine, and explained which business they are best suited to.

Countertop: Countertop card machines are a great choice for businesses who have a fixed till area and don’t require a machine that is portable. Best suited to retail, salons and some hospitality businesses.

Portable: Portable PDQ machines are perfect for businesses who operate within a large space and are required to move around or take the payment option to their customers. Best suited to large hospitality businesses

Mobile: Whether you opt for a mobile PDQ machine or mobile card reader, mobile machines are great for those who can rely on a bluetooth and 3G connection. Best suited to businesses on-the-go, those with no fixed abode, and businesses that require the flexibility of movement.

Thirdly, compare models and prices with Cardswitcher.

Remember to also take your customers' needs into consideration when selecting a card reader.

Should I buy or hire a PDQ machine?

As we mentioned before, merchants have to decide whether they want to buy their PDQ machine outright or rent/lease it from a supplier.

There’s a range of advantages and disadvantages so it’s difficult to say one is definitely better than the other. In the next two sections, we’ll look at both options in detail and will discuss the pros and cons of each.

Renting Advantages and Disadvantages

Renting a PDQ machine is quite simple. You agree to pay your supplier a set amount every month for a set number of months. After the contract runs out, you either return the PDQ machine or allow your deal to auto-renew.

So why is renting a good idea?

Well, if your business doesn’t have a spare £800 to spend on an ‘all singing, all dancing’ PDQ machine, renting allows you to spread the cost out over several years. This is especially important if you’re buying multiple terminals for your business as the costs can add up really quickly.

Renting a terminal (usually) comes with more support than just buying one. If it breaks, just let your supplier know and they will replace it. (Note: Check your contract carefully as this isn’t always the case.)

Good points out the way, why is renting not such a good idea?

The big one is that you tie yourself into a multi-year contract. If your business requirements change, being locked into a contract isn’t always ideal.

Also, if you add up all your monthly payments, it will almost always cost more than just buying the machine outright.

Last, while you’ll get a guarantee and might be able to take out additional support, you’re usually on your own if anything goes wrong outwith the standard warranty.

Buying Advantages and Disadvantages

Buying is also fairly straightforward. You pay the full list price in one go and own the PDQ machine outright.

What advantages are there to this option?

Well, if you have the cash, this is a great option as it’s cheaper in the long-run. It also eliminates the on-going monthly rental fees.

And the disadvantages?

If you buy the terminal outright, you usually take on all the repair, support and upgrade costs once the warranty has expired. So if your PDQ machine stops working one day after your warranty expires, you either have to pay for a new one or pay for the repairs.

Depending on your luck, this can actually make outright purchases a more expensive option than renting.

There are also problems with upgrading. If you want to upgrade your PDQ machine to the latest model, you have to buy it.

Conclusion

There you have it, Cardswitcher’s ultimate guide to PDQ machines.

From exploring the different types of card machines that are available, to what one is best suited for your business, we hope that our exploration has helped you out.

Whether you’re new to the small business world, or you’re twenty years in the making and looking to move with the times, a PDQ machine is a key player in ensuring the success of your business.

Happy shopping!