If you’re a business owner, then you will appreciate that every decision you make - big or small - is an important one. And selecting the right card reader is no exception to this!

At Cardswitcher we understand the importance of knowing everything about a product or service before you integrate it into your business. Which is why we want to provide you with all the information you need to pick the right card reader for you!

Therefore, we have created a review of one of the market leading card readers, Zettle. Exploring everything from software and hardware, to price and practicality - our review is sure to help you make that all important decision with confidence.

What is Zettle?

Set up in 2010, Zettle (formerly iZettle) is a Swedish card reader provider that aims to help small businesses succeed within a “world of giants”.

Providing businesses with a complete POS system, multiple e-commerce options and integration with reporting and inventory management software, Zettle is a great option for growing businesses.

In the last year or so, the Scandi card reader has joined forces with PayPal to create Zettle, which is when they modernised their name and continued their global expansion.

Overview

Having explored the ins-and-outs of Zettle, we have compiled a table of all the essential card reader information that we feel will help you determine if Zettle is right for you.

| Feature | Zettle |

| Cost of reader | From £29 |

| Best suited to | Zettle has a number of configuration options that make it a perfect choice for hospitality and retail businesses, as well as ecommerce. |

| Monthly fee | Free |

| Type of connection required | Wifi/4G Wireless Bluetooth Compatible with >iOS 12 and >Android 5 |

| Cards accepted | AMEX Mastercard Maestro Visa Visa Electron JCB Union Pay Discover Diners Club |

| Payment type accepted | Apple Pay Google Pay Samsung Pay CHIP and PIN Contactless |

| Warranty | Free for 12-months |

| Pros |

|

| Cons |

|

Cost

Of course when it comes to selecting a card reader cost is one of the biggest deciding factors. Which is why we have explored all of Zettle's pricing that you should be aware of when choosing a card reader.

| Cost | Zettle |

| Reader | From £29 |

| Additional Hardware | Cash drawer £49 Zettle Terminal From £149 Store kits From £189 Printer From £189 Barcode Scanner £219 |

| Monthly fee | Free |

| Chip and Pin | 1.75% per transaction |

| Contactless | 1.75% per transaction |

| QR Code/Payment Link | 1.75% per transaction |

| Refund | Free (transaction fee not refunded) |

| Chargebacks | Free (cover only up to £250) |

Accepting Payments

Zettle has created a seamless, hassle-free method of accepting payments with their mobile card reader.

With an easy to use pin pad, the reader accepts both chip and PIN and contactless methods with ease, with no need to transfer to the ZettleGo app to complete the transaction.

Zettle has, however, removed the ability to accept stripe payments as a safety precaution.

Practicality

Zettle has created a card reader that is suitable for all businesses no matter where or how they operate, as long as you can connect to wifi or 3G/4G. This makes the card reader a perfect transaction option for a variety of businesses, including food trucks, mobile hairdressers and so on.

With Zettle’s latest product offering, the Zettle terminal, you can checkout wherever your customers are. All you need is 3G or wifi, which you can get from Terminal’s preloaded SIM card.

Both the reader and terminal are equipped with batteries that are designed to hold a charge for a full day of operation (8 hours). If you have any issues with connectivity, charge or other queries about the reader, Zettle have a customer service team on hand Mon-Fri 5pm - 9pm.

POS App

Zettle’s POS app, Zettle Go, is equipped with a plethora of features designed to make day-to-day operations easier. You are required to have the POS app on your tablet or smartphone to accept, authorise and complete transactions.

In addition to the standard features that you would expect of a POS app, Zettle’s app can:

- Send online invoices

- Accept cash payments with no daily limits

- Issue and accept gift cards

- Send and store digital receipts

- Customisable, buildable product library

- Add photos and descriptions to all of your products

- Automatically update, edit and control stock levels

- Analyse sales and staff reporting with ease

All of the above features are free in the app, and can be downloaded to both iOS and Android devices.

Hardware Compatibility

Alongside their card reader and terminal, Zettle also offers customers the option to buy additional hardware. With a huge variety of hardware on offer, Zettle allows customers to configure and customise their ideal terminal set up.

The range of hardware available to purchase includes:

- Cash drawers

- Barcode scanners

- Printers

- Paper rolls

- Tablet stands

Software Compatibility

Zettle’s card reader is not solely compatible with Zettle’s software or the ZettleGo app, they have created software that works perfectly with third party software.

To allow your day to run smoothly, Zettle integrates with a range of apps which they have categorised into POS, Accounting and E-Commerce.

Some of the most recognisable apps that Zettle integrates with include:

- Adobe Commerce

- Goodtill

- Hike

- Quickbooks

- Shopify

- Starling Bank

- WooCommerce

- Xero

Security

Like the rest of the card payment industry, Zettle complies with the Payment Card Industry Data Security Standard (PCI DSS) requirements. Meaning that both yours and your customers data is encrypted and securely protected from unauthorised access from third parties.

Not only is their software tamper proof, in addition to this, Zettle have designed their card reader to self-destruct if someone attempts to tamper with it!

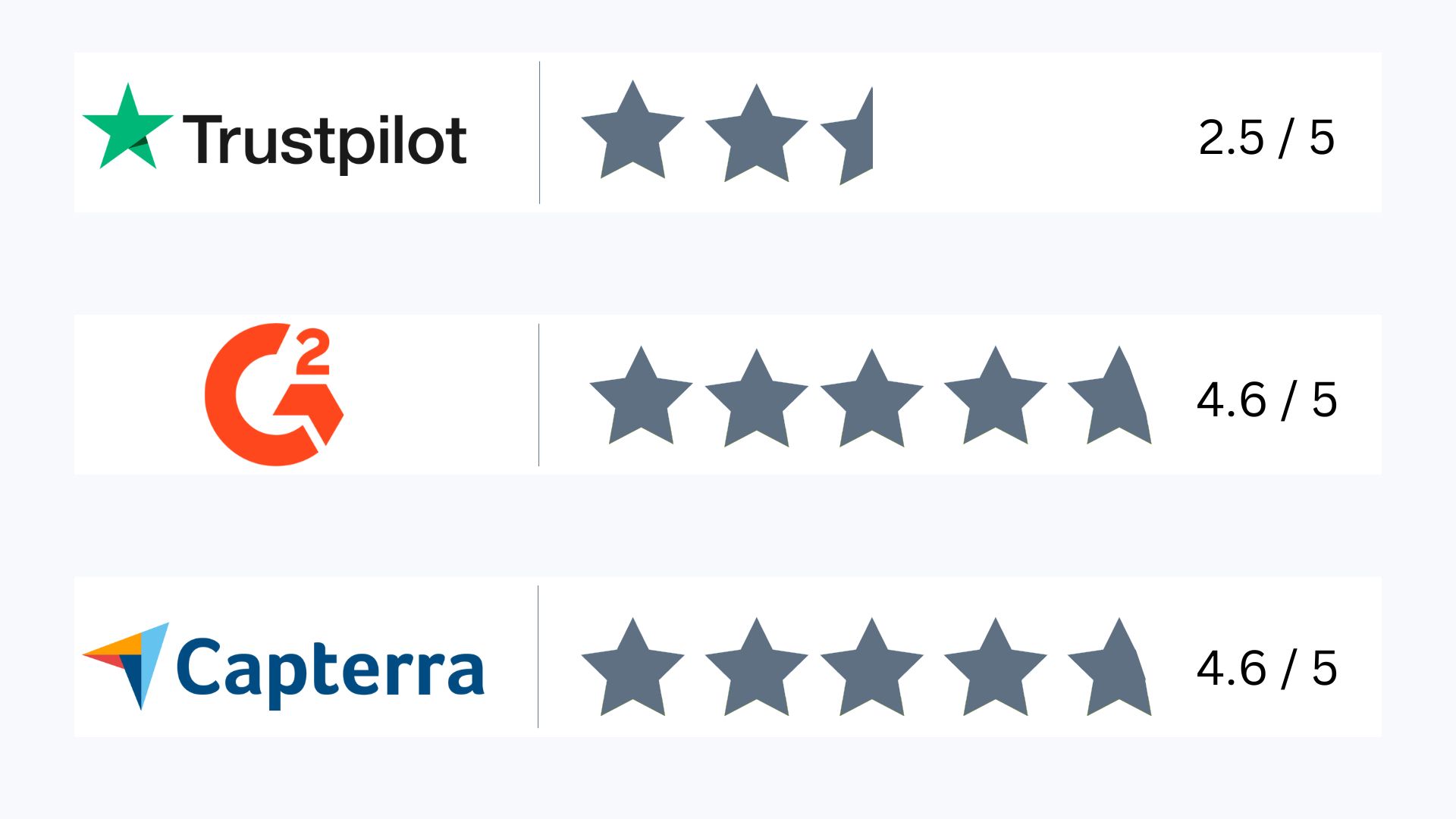

Customer Reviews

Zettle is a great choice for small businesses, microbusinesses, entrepreneurs and market traders. If you need a super simple POS paired with a tried-and-tested card reader, Zettle is definitely an option to consider.

Just look at what other businesses have said about being a Zettle customer:

Trustpilot - “The Zettle reader is brilliant…half the size of my previous provider, I wish that I had of switched a long time ago”

G2 - “Zettle is so easy to use!”

Capterra - “The best service to buy and sell quickly”

Alternative Card Readers

When it comes to choosing a card reader, small business quite literally have the pick of the bunch. There are plenty of mobile card readers on the market, from Square to SumUp to Zettle and Barclaycard! Heck, we rounded them all up and gave you a list of the best card readers!

But, if that’s not enough and you need more than our Zettle card reader review, we have also reviewed Square’s card reader. Or if you are still undecided, we have even compared the two in our Zettle vs Square review post!

Conclusion

Having divulged into every element of Zettle, from software and hardware to costs and security measures, there’s nothing we haven’t covered.

To conclude our Zettle review here at Cardswitcher, we believe that it’s fair to say that Zettle and its card reader is a great choice for small businesses.

Their competitive pricing married with their feature-rich POS app and customisable hardware options, makes Zettle great for a variety of businesses from retail to hospitality.

So what are you waiting for? Sign up to Zettle now.