From monthly rent payments to capital equipment purchases, all businesses come with a huge number of overheads. While some costs like rent and wages are hard to miss, others are easily overlooked. One of the sneakiest costs is processing customer payments.

While the difference between a good and bad deal looks fairly minor—a good deal might charge 0.5 percent and a bad deal 1.5 percent—payment processing fees accumulate swiftly. In our experience, merchants on bad deals can save hundreds or thousands of pounds per year by switching to a more competitive provider.

In this blog, we'll investigate all the individual charges involved with processing credit and debit cards. Then we'll take a look at a practical business case study to show you how to compare providers and select the best deal.

If you don't know how much you pay in payment processing fees, you're potentially losing hundreds or thousands of pounds every year. We could save you 40% on your current fees and it'll only take 2 minutes. Compare your credit card processing fees now.

Payment Processing Fees

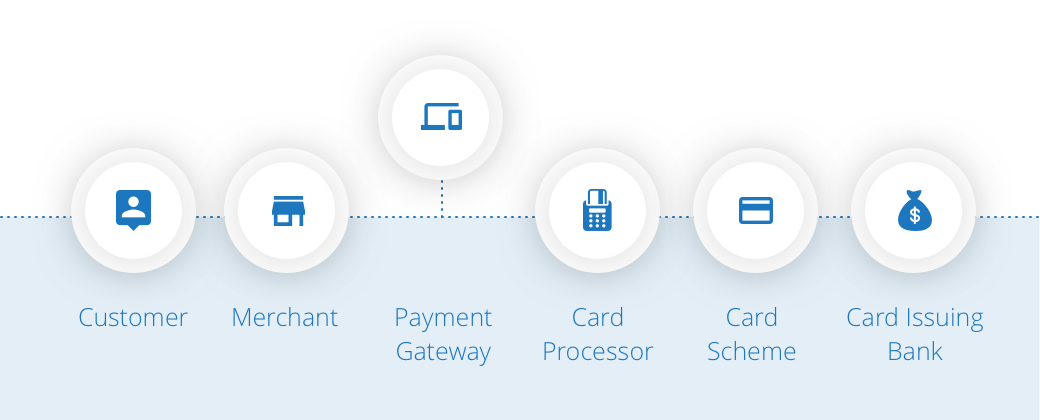

For every credit and debit card payment in the UK, there are a number of players involved throughout the transaction. Whilst there are a number of different players, the merchant deals exclusively with his or her fees to the credit card processor.

This illustration shows where each player gets involved during a transaction.

As we mentioned above, a merchant will pay a number of fees to their credit card processor. The core charges are detailed below with an estimated typical fee calculated for an SME with annual card turnover around £250,000.

Merchant Service Charge

Description: The charge on every credit or debit transaction you accept.

Typical Fee: Debit Cards (0.25% to 0.35%); Consumer Credit Card (0.7% to 0.9%); Commercial Credit Card (1.6% to 1.8%)

Terminal Hire

Description: The rental charge for your chip and PIN machine.

Typical Fee: Countertop Terminal (£14 to £16 per month); Portable Terminal (£17 to £21); Mobile Terminal (£20 to £24)

Authorisation Fees

Description: The additional charge for every authorisation on every transaction.

Typical Fee: 1p to 3p per transaction

Minimum Monthly Service Charge

Description: A charge levied if your transactions fall below a certain level.

Typical Fee: £10 to £20 per month

Set Up Fees

Description: A (sometimes avoidable) one-off fixed fee for the installation of new merchant facilities.

Typical Fee: £50 to £100

Chargeback Fees

Description: An administrative fee charged every time a cardholder requests a chargeback

Typical Fee: £10 - £20

PCI Compliance Fee

Description: An admin fee for completion of your annual PCI Self Certification Questionnaire and compliance certificate.

Typical Fee: £2.50 to £5.50 per month per MID

Case Study: Bakery24*

Background

Jennifer owns a bakery based in the heart of London. Every year, Baker24 turns over approximately £600,000 across 35,000 transactions with an even split between credit and debit cards.

When she first started the business, Jennifer simply didn't have time to compare payment processing suppliers and took out a contract with one of the best-known payment services companies.

Coming to the end of her credit card processing contract, Jennifer decided to dig into the payment industry and see if she could do better than her current provider.

* Business and customer names have been anonymised.

Current Monthly Breakdown

| Charge | Amount |

|---|---|

| Terminal Rental: | £15.00 |

| PCI Compliance | £4.00 |

| Credit Cards | £497.50 |

| Debit Cards | £175.00 |

| Total | £691.50 |

Cardswitcher Challenge

We entered Jennifer’s business details into Cardswitcher and received 13 different quotes from UK-based suppliers. The best deal we came up with was from Card Cutters with a total cost per month of £370.43 — an astounding 42% reduction from her original monthly bill.

That means if Jennifer moved to Card Cutters, she could save Bakery24 an astounding £3,852 every single year.

£691.50

Old Monthly Bill

£370.43

New Monthly Bill

Could You Save?

The case study above isn't anything unusual. The deal Jennifer was on was pretty typical for the market and if you phoned up a payment processor, you'd probably get quoted the same rates. That's why I tell people they can't just phone around the major players and assume they'll stumble on a great deal.

If you want the best deal, you have to compare offers from companies called Independent Sales Organisations (ISOs). ISOs represent hundreds of merchants and negotiate rates on their behalf, meaning they can drive down the fees payment processors charge.

At Cardswitcher, we let you compare ISO credit card processing deals from a number of providers, ensuring you get to see what the market really has to offer before you make up your mind. To get started, click here to go to our comparison engine.