In an era dominated by technology and a cashless society looming on the horizon, it is essential to your businesses success (and customers satisfaction) to accept card payments.

Whether it’s the cheapest, fastest or most technologically sophisticated, of course you are going to be searching for the best card reader on the market. And you’ve come to the right place!

Here at Cardswitcher, we aim to provide you with all the tools to make the decisions that are right for you and your business. So we have created an honest, transparent and trustworthy review of the market leading card reader, Square.

Square is a card reader company who aims to help businesses of any size succeed. Whether you’re just starting out and finding your feet, or you're a family business with bags of experience, Square card readers are a small businesses dream.

What is Square?

Square is an American card reader company that first entered (and dominated) the market way back in 2009. However, it was not launched here in the UK until 2017, by which point it had SumUp and Zettle to compete with.

The Square reader is a small device (around the size of a coaster) with a slot on one side for a credit card or debit card. You pair the card reader to a mobile device (a smartphone like an iPhone or a tablet like an iPad) via Bluetooth and use the Square Point of Sale (POS) app to set up each transaction in real time.

Overview of Square

To give you a complete understanding of what you get with Square, below we have outlined an overview of the Square card reader.

| Square | Overview |

| Device cost | Square Reader: £16 + VAT Square Terminal: £139 + VAT |

| Business suitability | Tailored solutions designed to help a variety of small businesses including salons, boutiques, bakeries and beyond. |

| Monthly fee | Free |

| Connection type required | WiFi Bluetooth |

| Cards accepted | VISA Mastercard AMEX Google Pay Apple Pay |

| Payment type accepted | Chip and PIN payments Mobile payments Contactless payments Clearpay |

| Warranty | Two year limited warranty covering software defects for Square Reader, Square Stand, Square Terminal and Square Register. |

| Pros |

|

| Cons |

|

Cost Overview

If you’re considering purchasing a Square card reader, we understand that you want to know what you’re paying for and every other cost involved. Which is why we have outlined each cost that you need to be mindful of with the Square card reader below.

| Feature | Cost |

| Reader | From £16 + VAT |

| Additional hardware | From £149 + VAT up to £979 + VAT (for entire register kit) |

| Monthly Fee | Free |

| In-Person Fee | 1.75% per transaction |

| Online Fee | 1.4% + 25p for UK card transactions 2.5% + 25p for non-UK card transactions |

| Manual Transaction Fee | 2.5% per transaction |

| Refund | Free (transaction fee not refunded) |

| Chargeback | Free |

Accepting Payments

As you can see, the basic Square reader has no screen or keypad. So you may be wondering “how does accepting payments work?”.

Well, with the Square reader you accept payments by connecting the reader wirelessly to your Apple or Android device via Bluetooth. Then, you will open the free Square point-of-sale app where you can accept payments easily, anytime, anywhere.

In addition to the physical card reader, Square also offers up a “virtual terminal” where you are able to charge cards from your browser, accept and record cash or gift card payments, send payment requests and split a transaction across multiple payment methods. On top of all this Square offers up additional free tools like scheduling payments, printing receipts and setting up a product library.

POS App

The Square POS app that you use to accept payments is a great tool, and is hailed amongst its competitors as one of the best.

If you have experience with POS, mPOS or e-commerce systems, it won’t take long to get your head around Square. Everything from setting up your products and product library to actually starting a transaction is pretty simple and intuitive. For the more technically-minded, the app has a bunch of excellent advanced features like product modifiers, categories and so on.

Another great thing about the app is you can set it up to operate in any number of different business environments. Say you’re running a food business, you can set it up to print kitchen receipts, include tipping options and manage reservations.

And behind all the smart business-specific stuff there are some outstanding core features like customisable receipts, digital receipts, split tender transactions and so on. The reports are handy too and give you access to reams of sales data.

If you want to test out the app before you commit to the Square Reader, you can download it from Android’s Google Play or Apple’s App Store.

Square Card Reader Overview

When it comes to practicality, Square is a top choice. As a portable card reader it has great battery life, plenty of connectivity options and Square doesn’t restrict you to exclusively buying their POS hardware, as it is compatible with a range of third party devices.

| Practicality | Square Card Reader |

| Battery life | Up to 8 hours of battery life. Or, a “full day of sales” according to Square. |

| Connectivity | All devices require Wifi and Bluetooth connectivity options to operate and link devices. |

| Compatibility | Compatible with all iOS and Android devices with Bluetooth connectivity. Compatible with a variety of third party hardware devices. Compatible with a huge range of third party apps, which you can explore on their app marketplace. |

Square Hardware

Square aims to provide businesses with an all-in-one solution to accepting payments. Which is why they provide customers with the option to purchase a variety of hardware.

This includes:

- Square Reader

- Square Terminal

- Printers

- Barcode Scanners

- Registers

- Stands

- Cash drawers

All of which are also available as a complete hardware kit, which can be tailored to your business needs.

As we mentioned above, Square doesn’t restrict you to only buying Square hardware exclusively. Their software is compatible with a huge number of third party hardware vendors, who may offer what you need if you can’t get it with Square.

Square Software

Here in the UK Square’s software is bespoke, and has been built to work for businesses of all sizes. They have created an integrated ePOS software that allows you to control sales, keep track of payments and manage inventory and stock levels.

With easy set up, Square’s system is simple to use and does not require any coding or web development experience. You simply follow their 5 step set-up instructions and you’re done!

Square’s software is compatible with a variety of eCommerce platforms such as WooCommerce, Xero and Wix, so that you can create a solution that works for you.

Is the Square card reader safe?

Square adheres to the Payment Card Industry Data Security Standard compliance requirements, ensuring that all data is protected, encrypted and never shared.

Square has a PCI Compliance Level 1, which is the highest level of security within the payment card industry. In addition to this, Square has an in-house security team monitoring server security and ensuring that it is never compromised, giving you that extra peace of mind.

There are a lot more security measures in place that protect yours and your customers' data, but that information is far too technical for our article.

Customer Reviews

Square is a very impressive company. Its business model is different to that of Zettle or SumUp as it’s focusing far more on its app and far less on its card reader. And so far, it looks like this gamble is paying off. Reviews are positive across the board and largely match our experience with the device and app.

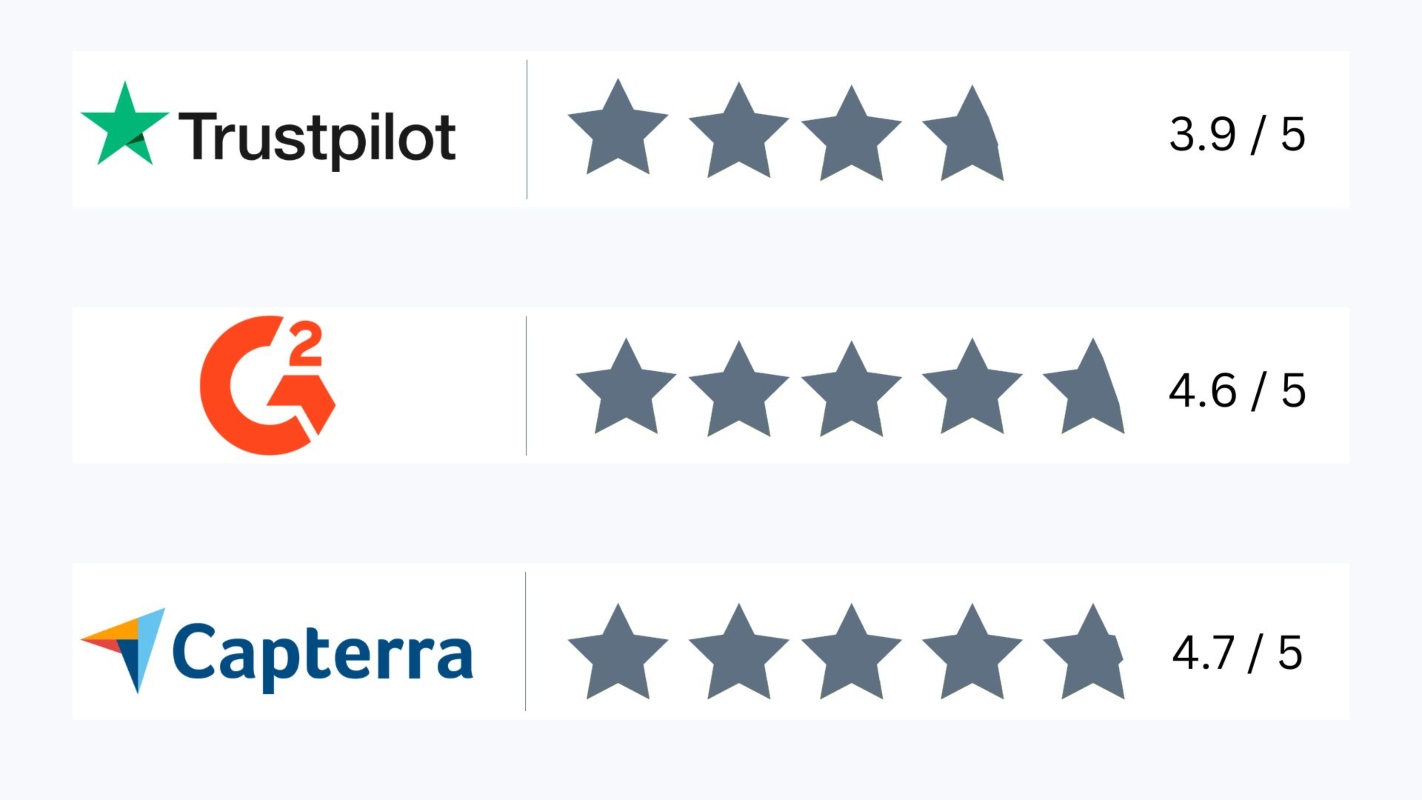

Here is a quick snapshot of customer reviews:

- Trustpilot: 3.9 / 5

- G2: 4.6 / 5

- Capterra: 4.7 / 5

However, as we’ve mentioned in other articles, Square’s long-term battle isn’t against other card readers, it’s against the established terminal rental model.

Alternative Card Readers

Looking at the customer reviews above, it looks rather peachy for Square. But reflecting back on the last time we reviewed the Square card reader, their customer reviews have dwindled slightly.

Now there’s no real reason or scandal to suggest why this may be, perhaps having more customers has just altered their positivity ratio slightly.

However, if you’ve been reading ours and customers reviews and decided that perhaps the Square card reader is not for you, then we suggest exploring some of our other card reader reviews such as Zettle and SumUp.

Is the Square Reader worth it?

Now that we’ve come to the end of our Square card reader review, you may be one of three people:

- Sold on Square and rushing off to purchase it now!

- Convinced that perhaps Square isn’t what’s best for you…

- …or just as confused as before.

If you’re the latter we suggest exploring our Zettle vs Square review to give you a comparison of what else is on the market, and how Square fairs.

With competitive transaction fees, a variety of hardware and well-designed software that’s easy to use, Square is a great choice. Whether you’re an organic highstreet cafe or a vintage clothing store, this card reader is sure to see you right.

To explore other reviews, information and card reader advice, explore the Cardswitcher blog!